In an effort to learn more about the food distribution industry, we spent time learning about Sysco, the largest North American food distributor, by perusing its regulatory filings. They yield many interesting learnings about the company and the industry overall, yet these documents tend to contain lots of detailed financial minutiae, so we combed through and highlighted below some of our favorite nuggets. The source for information & quotes below is Sysco’s 2015 10-K Filing (unless noted otherwise).

First, what is food distribution?

A food service distributor is a company that provides food and non-food products to restaurants, cafeterias, industrial caterers, hospitals and nursing homes.

A food service distributor functions as an intermediary between food manufacturers and the food service operator (usually a chef, food service director, food and beverage manager, and independent food preparation businesses operator owners.) The distributor purchases, stores, sells, and delivers those products, providing food service operators with access to items from a wide variety of manufacturers. Food service distributors procure pallets and bulk inventory quantities that are broken down to case and sometimes unit quantities for the food service operator. Most food service operators purchase from a range of local, specialty, and broadline food service distributors on a daily or weekly basis. Source: Wikipedia.

Basic facts: Food distribution market

- There are more than 16,500 companies engaged in the distribution of food and non-food products to the foodservice industry in the US (2014).

- Sysco estimates that they serve about 17.7% of this approximately $264 billion annual foodservice market in the US and Canada (2014).

- The foodservice, or food-away-from-home, market represents approximately 48% of the total dollars spent on food purchases made at the consumer level in the US (2014).

- The total foodservice market in the U.S. experienced a sales increase of approximately 0.7% in 2014 and 1.1% in 2013.

Basic facts: Sysco

As of June 2015, Sysco provides service to approximately 425,000 customers. Sysco’s customers in the foodservice industry include restaurants, hospitals and nursing homes, schools and colleges, hotels and motels, industrial caterers and other similar venues where foodservice products are served.

Services to Sysco customers are supported by physical facilities, vehicles, material handling equipment and techniques, and administrative and operating staffs:

- Sysco has approximately 51,700 employees. Sysco (and its operating companies) employs 12,800 sales and marketing representatives and support staff — 7,300 employees alone are marketing associates (details below).

- Sysco operates 197 distribution facilities throughout the U.S., Bahamas, Canada, and Ireland. Texas, California, and Florida alone house 25% of these facilities.

- Sysco owns approximately 22,384,000 square feet of distribution facilities, which is 82.9% of the total square feet of their facilities. That’s around 387 football fields. The remaining space is leased.

- Sysco operates a fleet of approximately 9,600 delivery vehicles consisting of tractor and trailer combinations, vans and panel trucks, most of which are either wholly or partially refrigerated for the transportation of frozen or perishable foods. Sysco owns approximately 95% of these vehiclesand leases the remainder. As context, the US Postal Service operates 211,264 vehicles (as of 2014).

What do all these marketing associates do?

Per Sysco’s Marketing Associate job requisition, marketing associates are regional outside salespeople. This means that associates take responsibility for a geographic region (in the case of the specific requisition above, a ~25 mile radius around St. Cloud, MN). Within their region, associates are responsible for meeting with customers and managing new/existing accounts. Restaurants and other Sysco customers turn to their regional marketing associate for help with questions about products, prices, availability, and product uses. Much of the sales/procurement and customer communication that these associates are responsible for happens over the phone, in person, and on pen-and-paper.

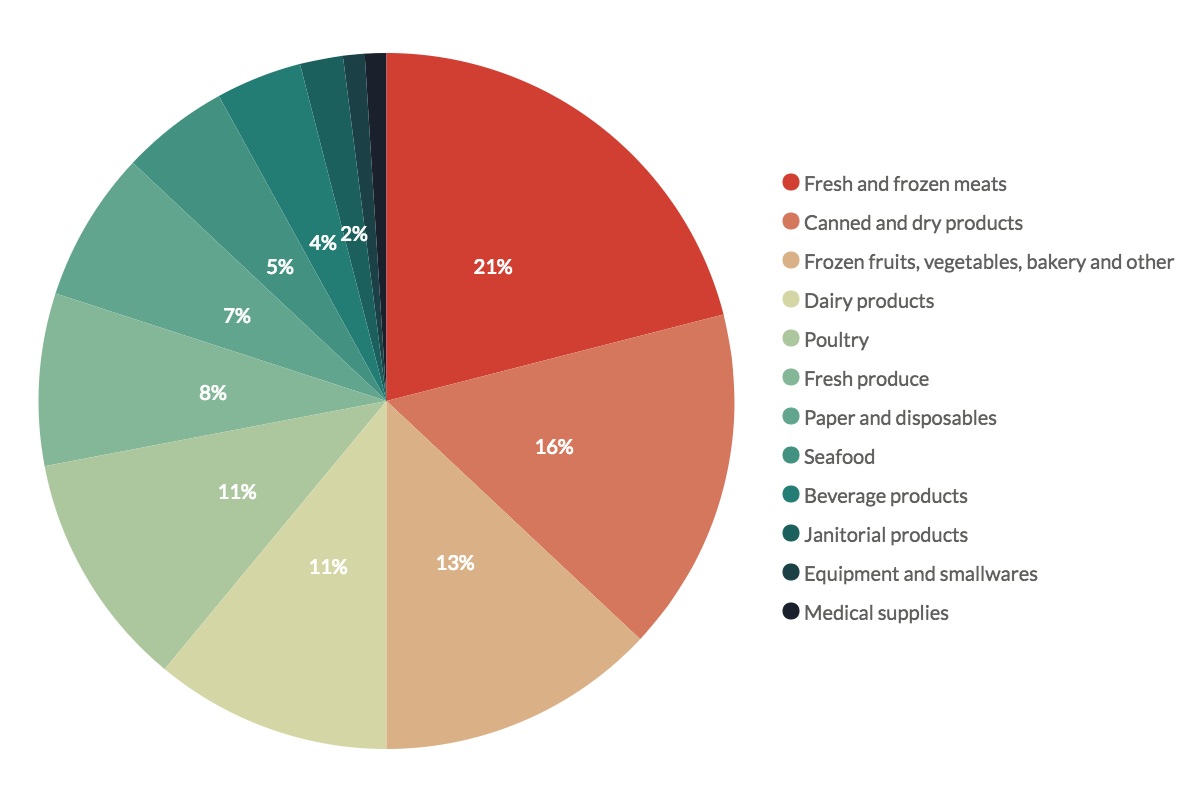

What does Sysco distribute?

Sysco distributes both food and non-food items:

This sales mix translates to the following revenues:

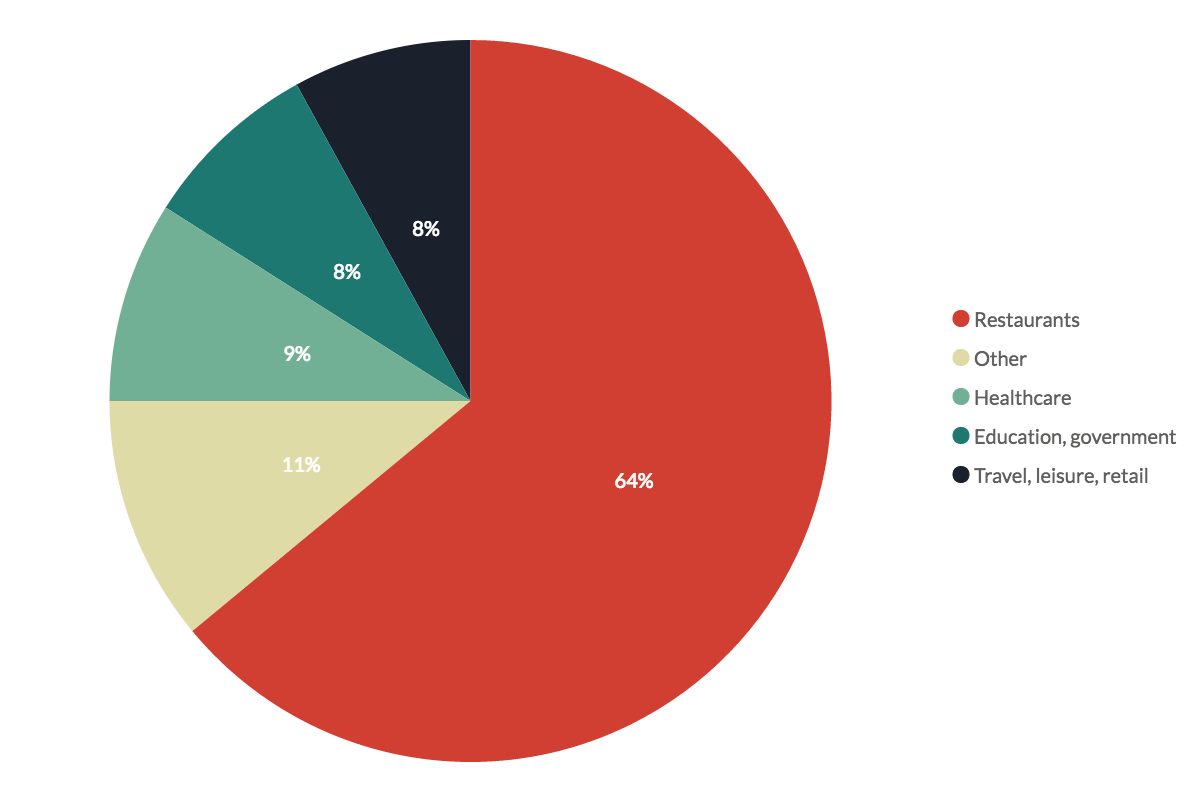

Sysco saw $48.68B in revenue in 2015. They sell these products to a variety of customer segments, predominantly to restaurants:

How do they distribute?

Sysco operates a variety of business segments to distribute their products to customers — the 2 major segments are called Broadline and SYGMA.

What is Broadline?

This segment is best explained by understanding what a standard broadline distributor is:

A broadline distributor services a wide variety of accounts with a wide variety of products, while a system distributor stocks a narrow array of products for specific customers, such as restaurant chains. A broadline distributor may carry up to 15,000 different items for purchase and operate sophisticated warehouse and transportation operations. Via Wikipedia.

As such:

Sysco’s Broadline operating companies distribute a full line of food products and a wide variety of non-food products (listed above) to both traditional and chain restaurant customers, hospitals, schools, hotels, industrial caterers and other venues where foodservice products are served.

What is SYGMA?

SYGMA is similar to Broadline, but these operating companies focus on distribution to certain chain restaurant customer locations, instead of independent or small chain restaurants (and other entities aforementioned) that Broadline is responsible for.

Other segments besides Broadline and SYGMA:

“Other” financial information is attributable to the company’s other operating segments, including the company’s specialty produce, custom-cut meat operations, lodging industry segments, a company that distributes specialty imported products, a company that distributes to international customers and the company’s Sysco Ventures platform, which includes a suite of technology solutions that help support the business needs of Sysco’s customers.

Of these segments, Broadline accounts for the majority of Sysco’s overall revenue:

Broadline is also much more profitable as a business segment than others:

Broadline distribution is clearly Sysco’s valuable business unit:

Broadline operations have significantly higher operating margins than the rest of Sysco’s operations. In fiscal 2015, the Broadline operating results represented approximately 79.4% of Sysco’s overall sales and 94.3% of the aggregate operating income of Sysco’s segments, which excludes corporate expenses.

Why is that?

We have invested substantial amounts in assets, operating methods, technology and management expertise in this segment. Things that make Broadline successful:

- The breadth of its sales force (described above)

- Geographic reach of its distribution area

- Resulting purchasing power

In contrast, SYGMA operations have traditionally had lower operating income as a percentage of sales than Sysco’s other segments. This is due to:

- The volume that these customers (chain restaurants) command allows them to negotiate for reduced margins,

- These customers are serviced through contractual agreements that are typically structured on a fee per case delivered basis.

What’s Sysco’s competitive advantage?

Sysco states its competitive advantage as follows:

- Over 7,300 marketing associates

- Diversified product base, which includes quality-assured Sysco brand products

- The suite of services we provide to our customers such as business reviews and menu analysis

- Multi-regional presence in the U.S. and Canada

- Portfolio of businesses spanning broadline, chain restaurant distribution, specialty produce, specialty meat, hotel amenities, specialty import and export which serves our customers’ needs across a wide array of business segments

- Sysco Ventures platform — developing a suite of technology solutions that help support the administrative needs of our customers

Given that Sysco is dependent on its field salesforce to generate revenue, power its most profitable business unit, and drive the company’s overall competitive advantage, the company would experience clear channel conflictwere it to service customers directly over the Internet — as one might suspect a disruptive tech startup would do. In other words, they’d disintermediate and ultimately obviate their own lucrative distribution channel.

Opportunity: SaaS-Enabled Marketplaces

We sought input from Brian Bush and Don Kahn, co-founders of a Sous, an AngelPad 9 company and SaaS-enabled marketplace that streamlines food distribution for restaurants and suppliers digitally:

That Broadline sales to restaurants account for such a large portion of Sysco’s business highlights the importance of independent restaurant buyers. High-volume chains have the buying power to negotiate larger contracts with fewer suppliers (in Sysco’s case, SYGMA), but independent restauranteurs maintain relationships with dozens of suppliers for different product categories.

Maintaining relationships with multiple suppliers gives restaurants some leverage over suppliers — in lieu of strong buying power, the threat of customer leakage keeps suppliers price-competitive. Having a diversified supplier list also gives buyers a greater range of choices when considering products for qualities beyond price, namely product quality and ethics(local, organic, etc).

On the supply side, the advantage of large distributors like Sysco over their smaller counterparts is in their sales reps, as no centralized online marketing channel exists for wholesale food. Pamphlets, word-of-mouth and cold contacts are still the normal marketing channels for suppliers, and buyers manage a fragmented purchasing system with little price transparency from suppliers.

SaaS-enabled marketplaces such as Sous centralize the purchasing process for restaurants while providing suppliers a direct line to a network of customers. A SaaS-based solution would save suppliers on the cost of their reps, give their customers easy access to their available catalog and allow them to reach a broader network through promotional e-commerce marketing channels. If you’re interested in Sous, feel free to reach Brian directly via email: brian@sousapp.com.

Conclusion

The food distribution industry is an interesting one with many moving parts. It’s valuable to explore the industry through the lens of Sysco, as it helps explain the industry and demonstrate where they may be interesting opportunities & advancements going forward.